Investors have been keeping a close eye on the Nasdaq 100 QQQ, Communication Services XLC and Transports IYT. The performance of these three indices has been on the rise in recent weeks, giving rise to a new bullish bias in the technology sector.

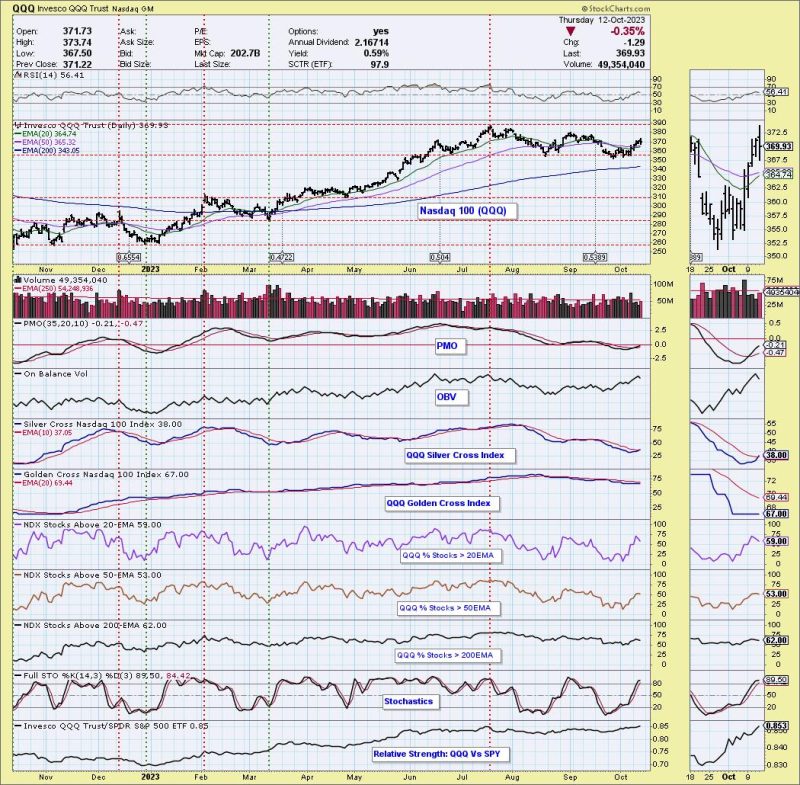

The Nasdaq 100 QQQ is an index of the 100 largest non-financial companies on the Nasdaq. The index has been in an uptrend over the past few weeks, climbing around 10% since the start of the month. Steady buying pressure has kept the index afloat and provided a good base for the Nasdaq Composite index, which is up more than 6% since the start of the year.

The Communication Services Select Sector ETF (XLC) has seen a similar trend as the Nasdaq 100 QQQ. XLC is composed of companies in the communication services sector such as AT&T, Verizon, and Liberty Global. The ETF is up around 9% since the beginning of 2021, suggesting a strong bullish sentiment in the sector.

On the other hand, the IYT Transport Select Sector ETF, which tracks transportation companies in the US, has seen its price rally around 14% since the beginning of the year. Companies included in IYT are UPS, JB Hunt, and YRC. The strong performance of the index is likely attributable to the steady increase in demand for goods and services due to the COVID-19 vaccine rollout and the return of normalcy to the global economy.

Overall, the performance of the Nasdaq 100 QQQ, Communication Services XLC and Transports IYT indices suggests a new bullish tilt in the technology sector. The strong performance of these indices reflects the optimism of investors in the US markets and the overall improvement of the outlook for the economy. With a stronger macroeconomic environment, investors are likely to continue to seek out technology-related companies and IYT may remain on a path of bullishness for the foreseeable future.