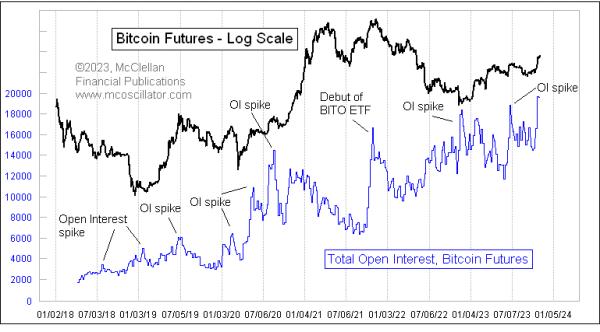

As crypto traders continue to await the trending ‘altseason’ to enter the markets, Bitcoin remains to dominate the landscape. As the leading cryptocurrency continues to move in its newly adopted sideways trend, the open interest in Bitcoin futures recently surged, reflecting an expressed desire by traders to remain in the market.

As highlighted by the data exhibited by Tradingview, the spike in Bitcoin futures open interest was seen over the past week, from June 7-14. The movement was observed on derivatives exchanges such as BitMEX, OKEx, and Huobi. This is indicative of traders’ growing optimism despite the market clearly not attaining the highs of earlier this year.

Cryptocurrency trader and analyst Crypto Michaël recently remarked on the unprecedented open interest in December’s open futures, revealing the following:

“#Bitcoin Bull Contine Yours #FOMO Look at December Futures open interest on Bitmex, ATH Again!”

Following the statement, Michaël’s sentiment was echoed by Asian crypto-twitter user ‘Joker’, who commented on the increasing open interest as the price of BTC continues to remain stable.

As of writing, Bitcoin is trading at around $9,700, up slightly from its monthly low of $9,166. This marks a significant increase from its March low of $3,850, with the cryptocurrency now bouncing off the higher range.

Crypto analyst Brdshaw recently weighed in on the open interest by suggesting the following:

“Open interest on #BTC futures is really interesting, it’s been creeping higher and higher recently. While it’s not a definitive signal for directionality, it is interesting to observe…”

Amid the uncertainty that the digital asset market may soon enter a so-called “alt season”, it is clear that there is still an underlying appetite among the crypto trading community for the asset. The open interest on the Bitcoin futures exchanges and the upward move in price are evidence of this.

Ultimately, as the markets continue to demonstrate a degree of volatility and stability, the open interest in Bitcoin futures will likely continue to climb, with traders undecided on whether they will benefit from taking a bullish or bearish position on the asset.