Investment grade bonds can provide lucrative profits for investors. However, navigating the financial markets can be daunting and complex. The McClellan Oscillator is an extremely valuable tool for investors to analyze investment grade bonds and identify the best opportunities.

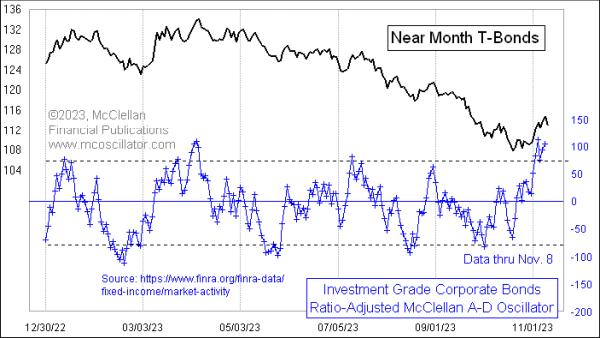

The McClellan Oscillator is a market breadth indicator created by Sherman and Marian McClellan in 1968. It is a technical tool designed to identify market trends, momentum, and oversold or overbought signals. This market breadth indicator measures the difference between the 19-day advancing period and the 39-day declining period of the daily Net Advances.

Unlike other leading indicators, the McClellan Oscillator provides investors with up-to-date information and forecasts. It typically follows a pattern of rising and falling values to sho acceleration and deceleration of the market. This indicator also allows individual investors to compare the market action of where the index is trading today versus a thirty, sixty, ninety, or one hundred and eighty day moving average of the index.

The McClellan Oscillator shows the internal strengths and weaknesses of the market as well as the direction the larger group of stocks are moving. This oscillator can help investors spot buying opportunities and identify stocks that are outperforming the market. It can also alert investors to the potential of a market reversal.

Investors can use the McClellan Oscillator along with other market indicators to gain insight into the direction of the economy and future of the market. By interpreting the McClellan Oscillator’s signals, investors can make informed decisions that will maximize their profits.

The McClellan Oscillator is a valuable tool for investors looking to capitalize on investment grade bonds. With the assistance of this oscillator, investors can make an educated decision on which investments best suit their needs. Not only will this indicator help identify the best investments, it will also increase the investor’s chances of long-term success.