The SP 1500, also known as the Standard & Poors index, is a stock index that tracks the stock prices of the largest companies in the United States. The index is composed of large, mid, and small-cap stocks, representing around 75 percent of the entire US equity market. Recently, there have been several metrics developed to track the performance of the SP 1500. One such metric is the Zweig Breadth Thrust (ZBT).

The Zweig Breadth Thrust is a technical indicator that charts the percentage of stocks within the SP 1500 pushing higher or lower compared to the overall index. This is typically used to measure the relative strength of the market. Its computation is relatively simple; it is the number of stocks pushing higher divided by the number of stocks pushing lower, multiplied by 100%. A reading of 100% suggests the market is the strongest it can be, with an equal number of stocks moving in both directions.

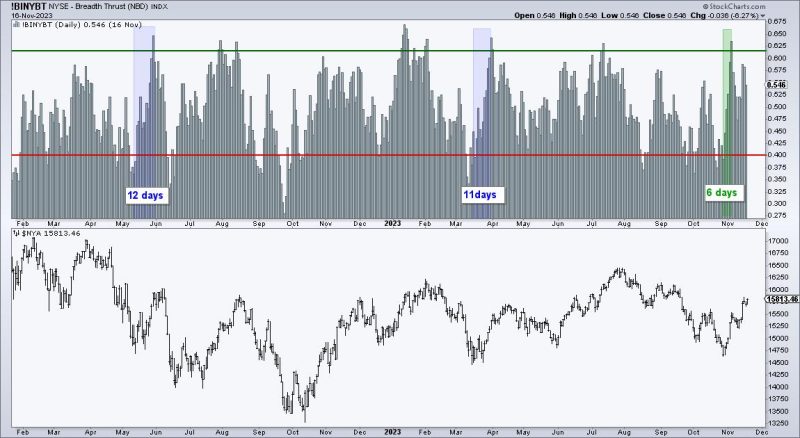

In technical analysis, the ZBT is used to determine potential entry and exit points of the SP 1500, based on divergences between the index and the indicator. For instance, if the ZBT breaks above 70%, it can often signal a strong trend in the overall market. Furthermore, with a ZBT reading of greater than 30% suggesting a reverse of a previous trend, the ZBT can be an effective tool to capitalize on a shift in the market.

The Zweig Breadth Thrust is just one of the many technical indicators that have been created to track the SP 1500 index. Together, these indicators can be used to better understand the movements of the SP 1500 index, and potentially make better investment decisions for the individual investor. As more metrics and indicators are developed, investors will have access to greater amounts of data, allowing them to better identify high probability trading opportunities.