Skepticism over the OPEC Oil Cuts

The Organization of Petroleum Exporting Countries (OPEC) recently announced plans to reduce production of oil in order to address a global supply glut. Despite a flurry of optimism in response to the announcement, skeptics remain unconvinced that the cutbacks will have a lasting impact.

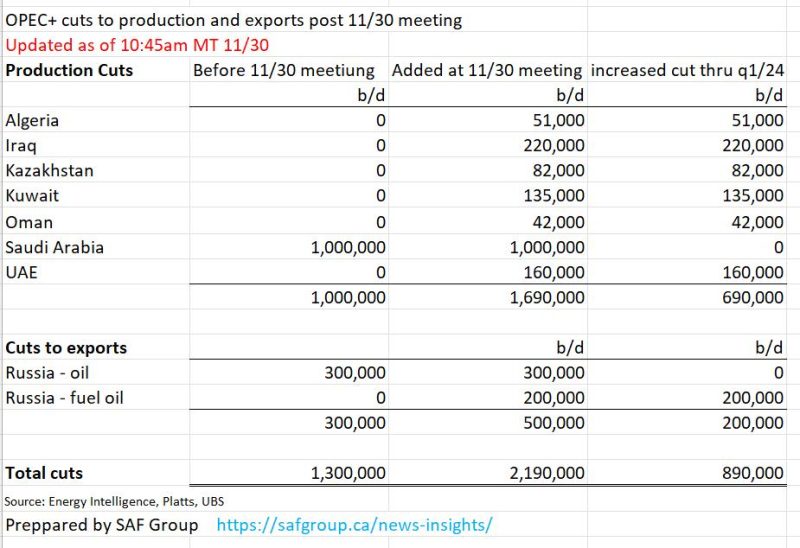

The OPEC agreement called for a reduction of 1.2 million barrels per day from its members, with a goal of maintaining the current level of global oil supply through the end of March 2021. While the move was met with cheers from the markets, some analysts remain skeptical that the cuts will make a meaningful difference for oil supply levels.

Worldwide demand for oil is down as global economies are affected by the ongoing pandemic, and the cuts are unlikely to be enough to reignite growth in demand in the near future. Further, the agreement only applies to the countries that are part of OPEC, so any oil produced outside of the agreement will still enter the market, further weighing on prices.

Moreover, the situation is made more complex by the presence of other powerful actors in the market, such as Russia. Russia’s state-controlled oil producer, Rosneft, has been unabashedly pumping out crude in large quantities – possibly to make up for the deficits caused by OPEC’s cuts – and is reportedly declining to participate in the agreement.

Oil industry experts are thus cautious in their predictions, as any meaningful recovery in prices is still contingent on the enforcement of OPEC’s new conditions. Until then, the markets can expect their skepticism to remain in place for the foreseeable future.