When you dive into the world of investing, there are few areas more mysterious than determining what stocks to buy and sell. One of the most important components of successful investing is understanding the Put/Call ratio. Put/Call ratio is the ratio of open-market put orders to open-market call orders. It is also known as the Equity Put/Call ratio.

Put/Call ratio measures investor sentiment and can provide valuable insight into the stock market. Put/Call ratio indicates whether traders are more bullish or bearish in the overall market. When the ratio increases, it reflects more Put orders and indicates that traders are bearish and expect prices to fall. When the ratio falls, it indicates bullish sentiment in the market.

There is no exact explanation for how the Put/Call ratio affects the stock market. However, it is believed that when the Put/Call ratio increases, traders are bracing for a market downturn, while the opposite is true when the ratio decreases.

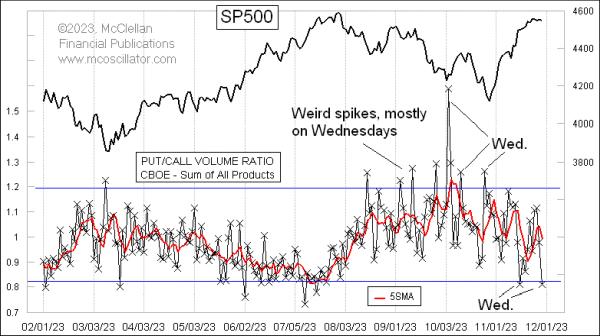

The Put/Call ratio is calculated daily and traders use it to gain an edge in the market. One way investors use the Put/Call ratio is on ‘Weird Wednesdays’. Traders watch the Put/Call ratio on the first Wednesday of every month to observe the direction of the Put/Call ratio from the past month. If the Put/Call ratio has been increasing over the month, traders will go short in the stock market on Weird Wednesdays, and vice-versa if the ratio has been decreasing.

Put/Call ratio is just one tool investors use to determine market direction. However, it is an important data point in achieving success in the stock market. By understanding the Put/Call ratio and how it affects the stock market, investors can gain a better understanding of where the market is heading. With this knowledge, investors can make informed decisions that could lead to profitable stock trades.